A breath of relief swept through global markets this week as Washington and Beijing inked their 2025 tariff truce, but not all the headlines tell the full story. On paper, dialing back 115% of tariffs signals progress and a rare moment of cooperation between the world’s biggest economies. Yet, beneath the relief, customs brokers sound alarms about the knotty “insurance” duty that lingers—an extra 10% tariff not easily ignored.

For many, especially small U.S. importers, this leftover duty isn’t just a technicality. It’s a maze of red tape and paperwork that could cost American businesses as much as $2 billion a year. Larger firms might weather the storm with in-house experts, but smaller players face an uphill struggle, left to shoulder the weight of ever-shifting rules and mounting compliance costs.

This new chapter in trade brings both hope and hidden hazards. While the tariff rollback makes room for optimism, the fallout from even a single lingering policy threatens to define daily reality for small importers already stretched thin.

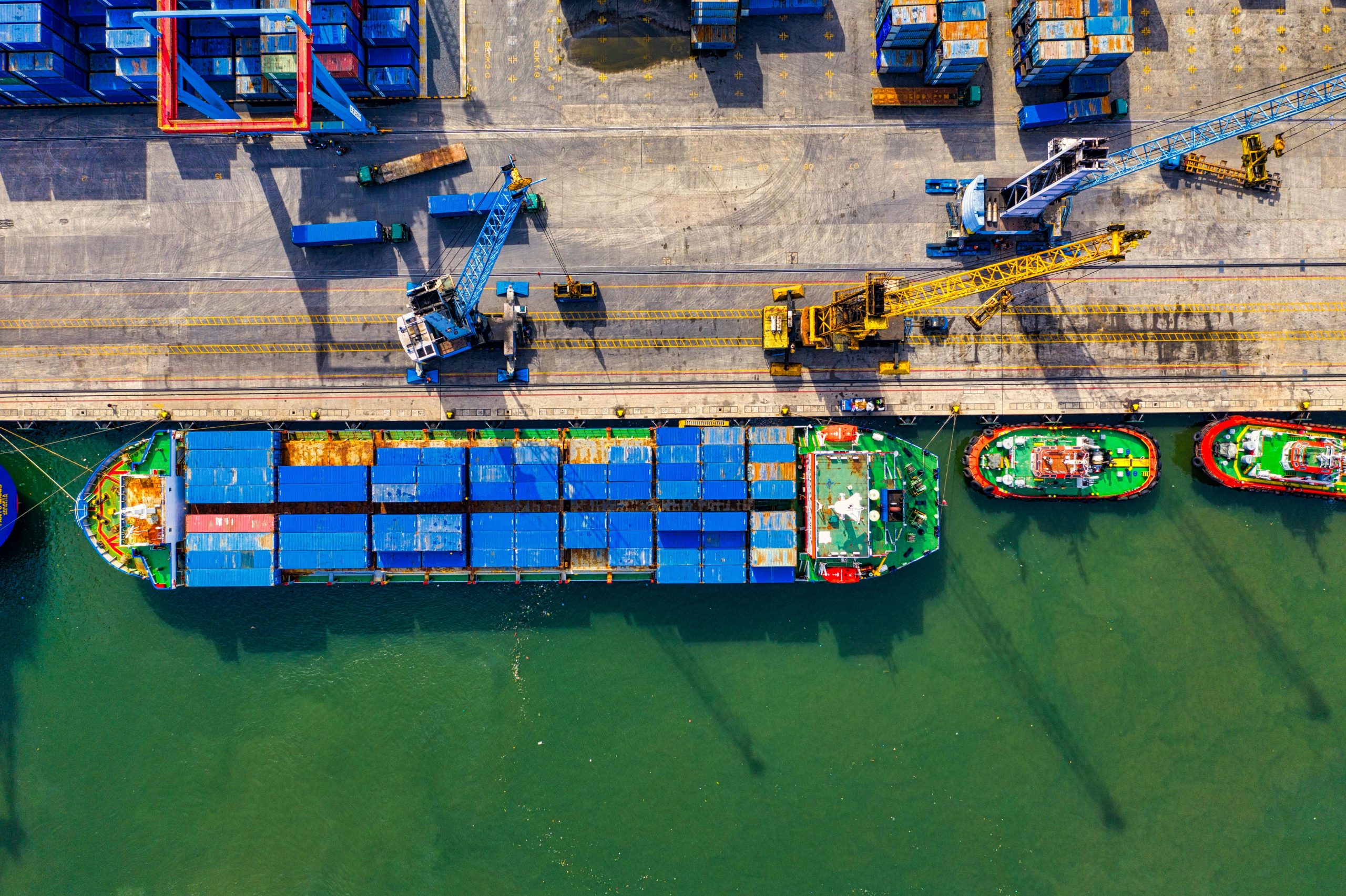

Tariff Truce Explained: What Did Washington and Beijing Agree On?

Photo by Kaboompics.com

This year’s Washington-Beijing tariff truce cuts through years of high-stakes brinkmanship and heavy levies. The new deal not only means measurable relief but also exposes new layers of political calculation and trade tension. Let’s break down how the numbers have changed and unpack the motives that brought two global rivals to the table.

The Numbers: Tariffs Then and Now

A year ago, US tariffs on key Chinese goods soared as high as 145%, hitting everything from electronics to toys. Customs declarations became a puzzle, and importers had to factor in huge costs that rippled from warehouses to cash registers. China answered with its own penalties, leaving both sides stuck in a painful standoff.

This truce slashes those headlining tariffs by a combined 115%. That dramatic rollback drops many product lines back near their pre-trade war levels. For major US importers of steel, electronics, and basic consumer goods, this feels like the removal of an anvil from their budgets. Similarly, large-scale Chinese exporters see renewed access to America’s shelves.

But a catch remains. The deal leaves a “safety valve”—an extra 10% insurance duty—on a core group of goods. US officials claim this is necessary to keep pressure on Beijing to uphold its side of the bargain, while trade advisors call it an administrative headache for everyone else.

- Key facts about the change:

- Tariffs peaked at about 145% on some Chinese imports.

- The current rollback removes 115% worth of penalties, a significant relief for most sectors.

- The new baseline is a 10% duty layered onto select product lines, designed to keep up negotiating pressure.

According to a recent Reuters report, stakeholders expect these new rates to boost monthly trade flows as businesses regain confidence. But, as noted by customs brokers, paperwork and compliance headaches are set to grow, especially for small importers lacking legal teams.

What’s Really Driving This Agreement?

The ink dried on this truce after months of meeting rooms pulsing with nerves and sharp elbows. The timing isn’t random—both sides face mounting pressure from business lobbies battered by trade war costs. American companies have lobbied for relief from compliance expenses and uncertain supply lines. Chinese firms, for their part, want the US market to stay open despite broader geopolitical strains.

Political strategy looms large behind the numbers. The tariff freeze blunts criticism ahead of a US election cycle where China policy is a hot-button topic. The Asia Times analysis points out that the US move fits a larger playbook: pressure China without risking an all-out collapse in trade. Keeping a 10% duty sends a warning, signaling that Washington isn’t ready to cede leverage, yet needs enough détente to keep the economy humming.

There’s another layer: rare earth minerals and technology. During negotiations, both sides tightened controls over critical materials, especially rare earths, which are vital for electronics and green tech. The truce allows some leeway, but restrictions remain poised to snap back if trust falters.

Consider:

- Business pushback: US and Chinese executives lobbied hard for regulatory relief, pointing to lost jobs and stalled orders.

- Supply chain caution: Both governments want to avoid more shocks to shipping, tech, and consumer goods.

- Tech and minerals chess match: The underlying struggle over semiconductors and strategic resources remains unresolved.

The result is a tense balance—tariffs fall, but watchdogs remain on alert. Supply chains breathe easier, yet risk lingers, shaped by wider rivalry and the next round of negotiations. For a quick explainer on how these tariffs work day-to-day, check out Harvard’s overview: How do tariffs work and how will they impact the economy?

The Complex Shadow of the 10% Insurance Duty

The 10% “insurance” duty, left standing amid slashed tariffs, isn’t just about added cost at the border. It’s a maze of forms, shifting definitions, and the ever-present risk of tripping over compliance rules. Customs brokers see this as less of a safety net, more like quicksand for the smallest importers. Far from a simple tax, this extra layer drags small businesses into a web of unclear regulations and mounting paperwork.

Why Customs Brokers Are Worried

Photo by Tom Fisk

For customs brokers, the leftover duty is not just another box to check. It means triple-checking every invoice and shipment code, knowing that a single misstep can result in delays or costly errors. The process of classifying goods has become a daily tightrope, with the rules open to changing interpretations.

Common compliance headaches include:

- Product classification

Customs brokers must match products to exact tariff codes. Ambiguities in product descriptions often lead to heated disputes and reworked filings. - Ever-changing documentation

Forms evolve with each new rule, and even seasoned importers scramble to stay current, often needing clarification from customs officials. - Regulatory ambiguity

It seems that every week, there’s a new memo or interpretation to digest. Brokers live with the fear that yesterday’s guidance could be invalid today, leaving shipments stranded.

Even experienced customs teams see the risk of extra audits or post-entry reviews rising. Delays are now more common. If brokers don’t get every line of paperwork just right, importers foot the bill—sometimes waiting weeks for goods to clear. This slippery environment creates a daily grind that smaller importers struggle to manage, especially when they lack on-call legal help.

For more, see how importers are turning to brokers to steer through today’s tariff rules in this Reuters coverage on customs brokers and compliance.

Compliance Costs and Who Pays Them

Analysts estimate that the continued 10% duty is about more than tariffs—it’s a $2 billion-a-year paperwork tax. The burden often trickles down, hitting small and midsize businesses the hardest.

Let’s break down how compliance eats away at smaller importers’ profits:

- Dedicated compliance teams are a luxury: Larger firms can keep in-house counsel on payroll. Smaller companies often rely on part-time help or try to figure things out alone.

- Every error has a price: A misclassified product or a late document risks penalties and shipment holds. Many small importers pay brokers extra for “hand-holding,” pushing up the real landed cost per shipment.

- Fixed fees add up: Even small customs user fees, which might seem trivial, quickly become an added burden when margins are thin. For a full list of recent U.S. customs fees and duties, check the U.S. Customs and Border Protection user fee table.

According to the U.S. Chamber of Commerce, about 97% of U.S. importers are small businesses. These companies often absorb compliance costs directly, passing higher prices to consumers or cutting jobs to stay afloat. The data is clear: the penalty for a missed detail or a single wrong box isn’t just lost time—it’s lost income, lost contracts, and sometimes lost companies. Read more about the ongoing effects on small firms in this analysis by the U.S. Chamber: The Cost of Tariffs on Small Business Imports.

Customs regulations that might feel like background noise to large multinationals are front and center for small importers. For them, each detail is another tripwire hidden amid the promise of “insurance.” The result? Many now see compliance, not just duty rates, as the key factor shaping their import plans.

Winners, Losers, and the Ripple Effects Across U.S. Supply Chains

Tariffs roll back, the news makes a splash, yet supply chains still ripple beneath the surface. For big players and the smallest importers, the outcome is far from the same. Some find relief, others struggle with new costs, mountains of paperwork, or slowdowns just as consumer demand sharpens. Here’s how America’s biggest companies and its smallest operators see the playing field, and how choices at the border trickle all the way down to neighborhood store shelves and factory floors.

Large vs. Small Importers: Uneven Playing Field

Photo by Kelly

The world’s largest importers—think Fortune 500 manufacturers or retail giants—move goods by the shipload. With scale comes power:

- In-house legal and trade compliance teams: Large firms track every regulation, adapt instantly to policy shifts, and use their size to negotiate with brokers.

- Superior bargaining power: Bulk shipments let them spread compliance costs thin, making a 10% insurance duty more of a footnote than a threat.

- Automation and tech: Multinationals use software to catch mistakes early, cut down on manual work, and anticipate new rules.

Small and midsize importers, though, often fight with one hand tied behind their back:

- Thin margins: A missed form or delayed shipment can mean the difference between profit and loss.

- Little access to expertise: Many rely on outside brokers, racking up fees or risking compliance gaps.

- Limited cash flow: Even a temporary delay leads to inventory shortfalls or lost sales while bigger firms pivot smoothly.

This uneven footing gets sharper every year. According to the U.S. Chamber of Commerce, over half of small businesses say compliance struggles make it hard to grow their business. Rising fees, time lost to paperwork, and ongoing unpredictability leave these firms exposed when global shocks or new rules hit. A detailed overview of small business compliance struggles can be found with the U.S. Chamber’s analysis.

For many, just keeping up with day-to-day compliance pulls focus away from finding new customers or improving products. Large importers might see policy shifts as bumps in the road, but for small businesses, each new requirement feels like crossing a mountain.

Consumer and Investment Goods: Price Pressures and Choices

Tariffs act like a stone dropped into a pond, sending waves across every part of the economy. Everyday items get more expensive; industrial investments slow as firms wait for uncertainty to fade.

How does this play out in real life?

- Consumer goods: Electronics, toys, and home goods see price hikes as importers pass along costs. According to J.P. Morgan’s research, tariffs push up consumer prices and can drive inflation, even if only by a few tenths of a percent.

- Investment goods: Manufacturers delay or reduce spending on machinery and upgrades, worried about unpredictable duties and shifting rules.

- Inventory headaches: Wholesalers and retailers face tough choices. Should they overstock to hedge against new fees or keep inventory light and risk empty shelves?

- Job market effects: Factories and supply firms sometimes freeze hiring or cut hours when their costs and demand forecasts are uncertain, creating waves in local job markets.

Communities that rely on imports, distribution, or local manufacturing feel these effects up close. Small towns with local assembly plants or freight hubs can see jobs dry up quickly if a key supplier pulls back.

The University of Virginia’s supply chain explainer breaks down how ripple effects can reach every corner of the country—from ports and highways to supermarkets and factory floors. Meanwhile, for importers, higher overhead reduces room for raises or investment, making it tough to keep up with bigger, better-resourced competitors.

When every link in the chain gets tugged, no one is quite sure when prices will stabilize or jobs will bounce back. In the end, both companies and consumers pay, in ways that often go far beyond a simple tally on a customs form.

The Road Ahead: Is This Truce Built to Last?

Photo by AlphaTradeZone

Photo by AlphaTradeZone

The ink on the tariff rollback still glistens, but doubts linger about how sturdy this peace will be. For every public promise of stability, there’s a whisper that the ground beneath is unsettled. Trade watchers, importers, and policymakers are all asking the same thing: is this choreography the start of lasting calm, or a truce that covers cracks waiting to widen?

Ongoing Negotiations: Balancing Caution and Optimism

The talks between Washington and Beijing lead to cautious optimism—but not certainty. The current agreement slashed most tariffs, yet it leaves a 10% “insurance” duty in play and key issues unresolved. U.S. officials have made it clear that, for now, tariff levels won’t shift further. Commerce Secretary Howard Lutnick said recently that Americans shouldn’t expect any more sudden changes, a statement aimed at keeping nerves calm on both sides of the Pacific.

Yet, the deal’s permanence still feels shaky. Analysts point out that, while both sides have taken real steps to ease pressure, many provisions remain temporary, with mechanisms for continued negotiation and review. A recent New York Times analysis highlights how quickly the agreement could unravel if political winds shift or trust thins.

Regulatory reviews and committees are baked into the agreement, meaning both sides can revisit tariff levels if they feel the other isn’t holding up their end. The trust deficit is real, and history shows that even small spats can reignite bigger trade wars.

Compliance Uncertainty: Complexity as the New Normal

The truce may have cooled tensions, but it did not simplify life for businesses. The 10% duty might remain steady in percentage, but its application is anything but simple.

That extra layer of compliance acts like a narrow bridge over a river of shifting rules. Customs brokers and smaller importers report spending even more hours untangling paperwork and sorting out item codes. Some fear that new government reviews and periodic negotiations will mean frequent adjustments, each time forcing companies to scramble and recalculate.

Here’s what keeps small firms on edge:

- Temporary export licenses: Some critical materials like rare earth elements, used in tech and defense, are only available under six-month permits from China.

- Regulatory “gray zones”: Major rules around which products or components get hit with export controls or monitoring could change at any time, creating inventory or supply shortfalls overnight.

- Persistent need for expert advice: As policies shift, only businesses with access to up-to-date trade intelligence will keep ahead. For small importers, the cost of compliance is no longer a one-time problem—it’s the new cost of doing business, recast as a permanent burden.

For a detailed look at how ongoing updates to export and tariff regulations are handled, see the framework outlined in recent trade talks coverage.

Geopolitics and Fragile Supply Chains

Neither side can afford to ignore the elephant in the room: control over rare earths, chips, and global supply chains. China’s grip on minerals vital for electronics, batteries, and autos makes these talks about much more than trade—it’s about who writes the rules for the next decade.

As part of the deal, China has agreed to issue six-month export licenses for certain rare earths and magnets, key to U.S. manufacturing. But these permits can be changed or revoked at short notice, keeping American companies nervous. It’s a bit like renting an apartment with a six-month lease and no guarantee of renewal. This keeps U.S. manufacturers on edge, especially those in defense and green energy sectors, forcing them to source backup suppliers or hold more inventory “just in case.”

Meanwhile:

- Both sides reserve the right to “revisit” rules if relations sour.

- The push for onshoring chip manufacturing and securing alternate mineral suppliers is growing, but results won’t happen overnight.

- Global partners—including Europe and Japan—watch closely, aware that any slipup could ripple through their own supply chains.

For a broader discussion on the consequences of rare earth export controls and the new framework for tech trade, visit this Reuters review of the Geneva trade agreement.

Where Does This Leave Global Businesses?

If you’re a business reliant on cross-border trade, the message is clear: stay nimble. The handshake is firm today, the truce headline-worthy, but back rooms are busy planning for resets and reprieves.

- Some multinationals use the “insurance” phase to diversify suppliers and invest in compliance systems.

- Small importers brace for ongoing audits and sudden tweaks to the rules.

- Global capital holds back on big moves until deals feel permanent, not provisional.

The risk of sudden change hovers. All eyes stay on the next round of meetings and updates, hoping that this truce matures into true stability and does not reveal itself as a Trojan Horse hiding the next disruption.

Conclusion

The tariff truce brings a fresh sense of relief yet carves deeper lines between winners and those left holding the bag. Big companies breathe easier, but many small importers now stare down costs and complexity they are not built to handle. The extra 10% duty might look like a simple insurance policy, but for thousands of Main Street businesses it’s a daily test that reshapes which products make it to store shelves and which firms survive the year.

This peace, fragile and wrapped in red tape, puts the smallest players at the most risk. Every new form adds weight, every audit threatens cash flow. Owners and workers in small import shops, family-run supply chains, and niche wholesalers should stay alert to the next twist in policy. What looks like calm at the top of the trade ladder is, for them, a storm brewing just over the horizon.

Policy shifts often land hardest on those with the smallest cushions. If you depend on global suppliers, follow every update. For small importers, vigilance isn’t optional—it’s the only way to stay afloat as the trade winds keep shifting.